(Excel is so good that I use it for my LLC)

Then you'll discover how to set up a business and stop worrying about self-employed payments, VAT, agencies and so on, completely legally!

You cannot have salaried employees in Spain hired directly by your LLC, as this would create a "Permanent Establishment" and require you to pay taxes as a Spanish company.

However, you can hire freelancers, as long as they don't work exclusively for you or use permanent physical facilities in your name.

Of course it's possible! You can even register your business without having to travel, obtain a visa, a social security number (SSN) or an individual taxpayer identification number (ITIN). U.S. regulations do not impose restrictions on business formation for citizens around the world, except in some countries subject to trade sanctions.

If the LLC operates online without a physical presence in the United States, has no employees or dependent agents, and none of its partners are residents or citizens of the United States, it will be classified as Foreign Owned and will not be considered “Engaged in Trade or Business.” in the US» (Engaging in Trade or Business in the United States). By not having the ETBUS designation, it benefits from a territorial exemption in tax terms. In short, if the LLC meets these requirements, it will be exempt from taxes in the United States. Otherwise, you will not enjoy the exemption and must obtain an ITIN number and pay taxes in both the US and your country of tax residence.

The LLC is a versatile structure for digital entrepreneurs and non-physical businesses with a global clientele. It offers benefits such as limited liability protection, management flexibility, access to US financial markets, and operational efficiency for your global expansion. It's important to evaluate the compatibility of your business with the structure to ensure regulatory compliance.

If your business has a physical presence or Permanent Establishment in Spain (e.g., a restaurant, brick-and-mortar location, salaried employees), an LLC alone is not sufficient. In these cases, an LLC can complement a local entity (such as a Spanish limited company) for the international or digital aspect of its activities, ensuring compliance with the tax regulations of both countries.

Model 720 (Informative): The LLC must inform the State Tax Administration Agency (AEAT) about the assets and rights located abroad that belong to it, provided that the total value exceeds 50,000 euros. This filing is made annually and includes detailed information about bank accounts, securities, insurance, property, and other relevant assets.

Related transaction information: In the event that the LLC carries out transactions with related parties, whether they are people or entities with which it maintains a special relationship, it is necessary to maintain documentation that supports said operations and establishes its market value. In the case of an inspection, this information will be required to be provided to the AEAT.

If you live in Spain and personally provide your business services (consulting, design, marketing, management, etc.), Social Security considers that there is direct economic activity as a natural person.

In that case, they may require you to be registered as self-employed and, if you are not, they could impose retroactive penalties and fees.

If your business model does not depend on your personal work (infoproducts, SaaS, delegated services, agencies with a team, automated e-commerce, etc.), there is no personal activity and you would not have an obligation to pay social security contributions.

The LLC remains fully valid for operation, but it is important to adapt your structure to this current interpretation.

Annually, we will file the following forms with the IRS on your behalf:

Form 1120: This document informs the IRS about the income and expenses incurred by your LLC during the tax year.

Form 5472: This form provides the IRS with information about the type of business and the details that will be filed on Form 1120.

Counting from the year you founded the company and every 5 years, you must fill out a BEA report:

Additionally, if you operate or plan to operate in the United States, you may need other forms. Initially, if your activity is focused on Europe, you probably don't need to worry about them:

Form W-7: Used to request the ITIN number from the IRS, similar to the EIN, allowing you to comply with your tax obligations in the country.

Form 1040NR: This form is essential at the end of the tax year to demonstrate to your country of tax residence that you have paid taxes in the United States, which could allow you to deduct them in your country of taxation.

Form 8-BEN: Requested by companies that must pay taxes on behalf of your company in the United States. In this case, the ITIN will be required.

VAT management for an LLC operating internationally depends on the nature of the services/products and the location of the customers. For B2B services, reverse charge tax may apply. For B2C services in the EU, there are regimes such as OSS. It is crucial to ensure compliance with the tax regulations applicable in each jurisdiction. Consult an expert for your specific case.

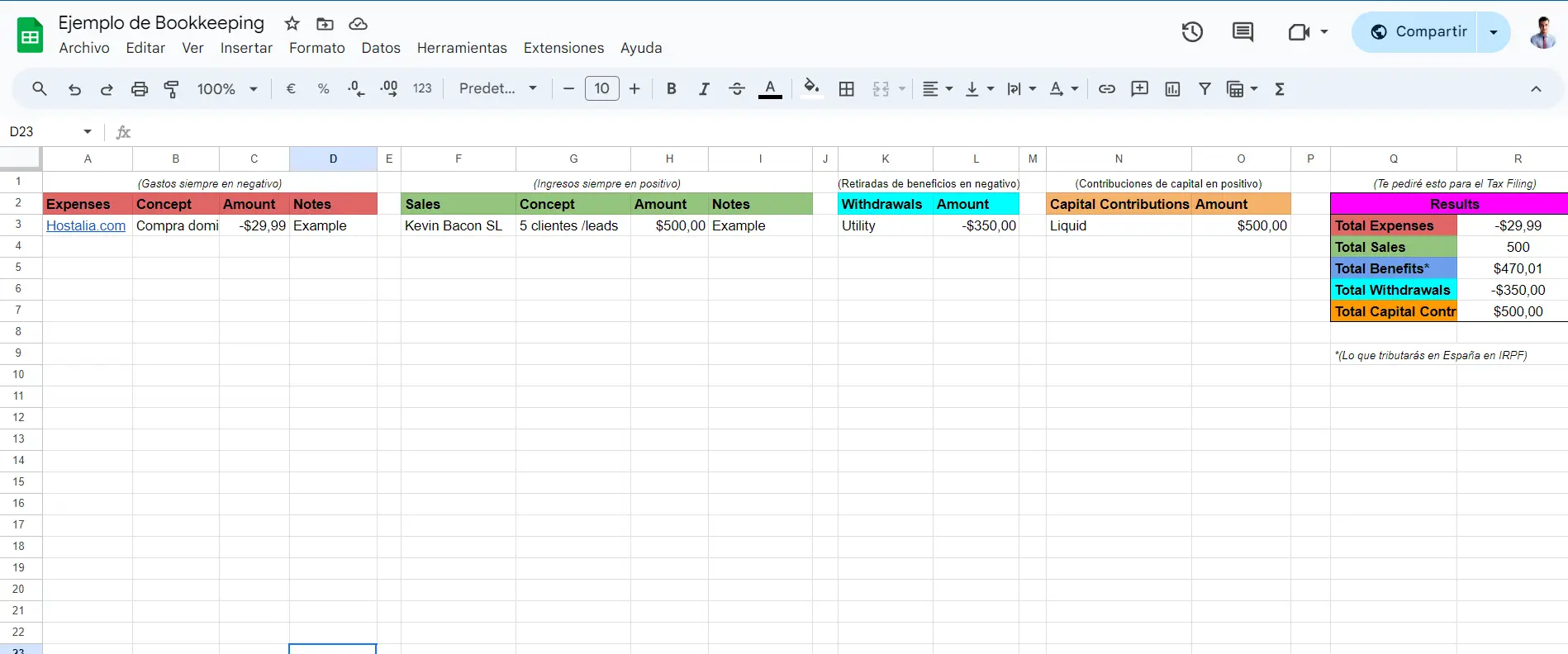

Before making any expenditure, it is crucial to keep a detailed record of it. You can use a spreadsheet like Excel to keep track efficiently, and in order to make this task easier for you, we will provide you with a template to use.

That said, it is important to note that there are certain expenses that your LLC will be able to deduct, and therefore, you will need to keep the corresponding invoices and transfer records and ensure that they are registered in the name of your LLC:

Common Deductible Expenses:

Automobile Expenses: If the LLC uses vehicles for business purposes, it is possible to deduct automobile-related expenses, such as gasoline, maintenance, and depreciation.

Business Education Costs: Costs associated with continuing education or business-specific training may be deductible.

Commercial Insurance: Insurance premiums for commercial coverage, such as liability insurance, may be deductible.

Charitable Contributions: Donations to charities may be deductible if they meet certain requirements.

Commercial Taxes and Licenses: The fees and licenses required to operate the business are deductible expenses.

Keep in mind that you will not be able to deduct expenses that are directly linked to the country, such as offices or property, as this could create tax complications for your LLC by operating exclusively from your country of residence.

If your LLC makes a clear separation between business and personal accounts, maintains accurate accounting in Excel, meticulously saves all invoices, and has an Operating Agreement, you have no reason to worry. However, if not, there is the possibility that a judge in the United States will 'pierce the corporate veil', putting the legal protection of the LLC at risk. For this reason, it is essential to rigorously comply with all the aspects mentioned above.

It is only required that the company be duly incorporated and current with all its documents, including the EIN number (company tax identification), and the manager's updated passport. It is not necessary to have a Social Security Number or ITIN. We cannot guarantee account opening, as banks must conduct a security check called KYC (Know Your Customer), which is mandatory under federal regulations established in the Patriot Act, before approving a customer. .

In the event that we are unable to register your business within 60 days due to an error on our part, we will refund the full amount you paid, with no questions or explanation required.

If you receive a notification from the tax authorities, it's essential to remain calm and prepare documentation demonstrating your LLC's compliance with applicable regulations. This includes the Operating Agreement, management contracts, bank statements and accounting records, and US tax forms. It's crucial to prove the LLC's effective management outside of Spain and that a Permanent Establishment has not been established in your country of residence. Always seek the assistance of a specialized tax advisor.

Yes you can, but keep in mind that any profit generated from crypto or NFT transactions must be declared on your Spanish personal income tax return under the income attribution regime. The Treasury closely monitors these activities, so keep accurate documentation of all transactions.

The easiest way is to use platforms like Wise, Payoneer or Stripe, which allow you to receive payments in euros, easily convert currencies, and transfer funds to your European bank account from the LLC.

YeahEven if you don't have any profits, you'll need to file information forms 5472 and 1120 in the U.S. each year to keep your LLC active.

In Spain, if you don't have any real profits, you won't be required to pay personal income tax, although it's a good idea to keep supporting documents to prove your lack of income.

It is not legally mandatory in all states, but it is highly recommended. The Operating Agreement protects your limited liability, strengthens your position against tax audits, and prevents misunderstandings about who actually exercises effective management of the company.

In LLC.Devil.MarketingWe are with you every step of the way to open your bank account from the comfort of your home. We do our best to make the process easier for you, but keep in mind that the final say lies with the banks and their own regulations.

If for some reason things don't go as planned, no problem. We offer you 60 days from when we receive your documents to request a refund, as long as there are no delays from the IRS or the State, as those are out of our control.

At times, the US or Spanish tax authorities may require additional information, which could complicate the process. In those cases, and even if we regret it, we will not be able to make a refund.

We understand a lot about business, but for legal or tax matters, it is best to consult an expert. A lawyer or accountant will be your best ally for binding tax and legal consultations.

Although we are here to support you, remember that we are not lawyers. For those more complex legal dilemmas, we will help you find a qualified professional.

The information provided may change, so we recommend that you do not consider it immutable.