Compare operating as Autonomous vs LLC attributed. The fees and maintenance are deductible from the personal income tax base of your type.

| Name | Total |

|---|

Updated reference guide (2025) on the mandatory registration in RETA for LLC partners residing in Spain.

| Type of Activity | Partner's Role (You) | Risk Level | Technical and Operational Analysis |

|---|---|---|---|

| Professional Services Marketing, Consulting, Programming, Copywriting |

Direct Executor. Billing depends on your hours. |

MANDATORY REGISTRATION |

"Highly Personal" Criterion: If you regularly invoice high amounts (>SMI), the Tax Office assumes you work from Spain.

Opinion: Here, RETA and the Tax Office are mandatory to avoid tax fraud through simulation. |

| Micro-Activity Side-Project, Beta Testing, Residual Income |

Bootstrapper (< SMI). Low or no LLC billing. Profit ~0. |

NOT MANDATORY** |

Jurisprudence Shield: Without income above the minimum wage, there is no "regularity" for RETA.

Strategy: Without registration in the Tax Registry to avoid admitting "Permanent Establishment". It is declared in the annual Personal Income Tax return under the Income Attribution Regime (RAR). |

| Business Activity Amazon FBA, Dropshipping, Automated SaaS |

Manager / Admin. The system generates the sale. |

NOT MANDATORY* |

Criterion "Entity Activity": The LLC conducts the business.

*Condition: Remote management. No physical office or employees in Spain to "materialize" the company here. |

| Agency with Structure You subcontract the technical execution |

Commercial Director. You get clients, others execute. |

GRAY ZONE |

Depersonalization: If third parties execute, the personal link is broken.

Risk: That your "management" role be considered a highly personal activity. |

| Holding Company Stocks, Crypto, Real Estate |

Investor. Mere possession of goods. |

EXEMPT | Mere Possession: Managing one's own private assets never requires registration in RETA. |

| International Transition Imminent departure (< 60 days) |

Settlement. Residual pre-transfer activity. |

DEFENSIBLE | Lack of Habituality: By breaking tax residency soon, you attack the time requirement. |

This table has a strategic character. (**) The "No Census" strategy for micro-activities aims to avoid the presumption of Permanent Establishment, based on the fact that the activity is carried out by the foreign entity. It requires meticulously declaring income in the Personal Income Tax Return (RAR).

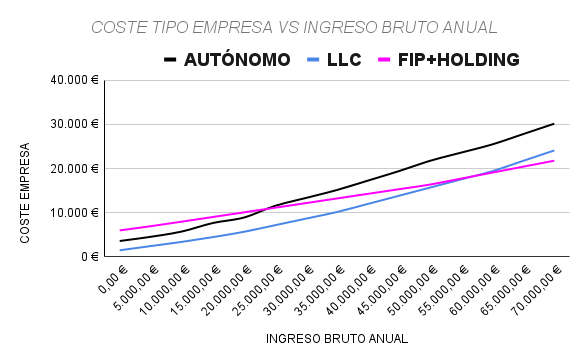

This graph shows the evolution of the annual operating efficiency and available capital potential based on gross income, comparing different business structures:

🔎 Key insights:

✅ Up to 25k income: The Base Structure optimizes agility and available capital for your startup or growth.

✅ Starting at 25k income: The Advanced Structure offers greater operational efficiency and asset protection for larger projects.

✅ From 100k income: Advanced structures enhance resource allocation and asset protection for large-scale expansion.

🚀 Optimize your Global Operations and Boost your Growth.

In LLC.Devil.MarketingWe are with you every step of the way to open your bank account from the comfort of your home. We do our best to make the process easier for you, but keep in mind that the final say lies with the banks and their own regulations.

If for some reason things don't go as planned, no problem. We offer you 60 days from when we receive your documents to request a refund, as long as there are no delays from the IRS or the State, as those are out of our control.

At times, the US or Spanish tax authorities may require additional information, which could complicate the process. In those cases, and even if we regret it, we will not be able to make a refund.

We understand a lot about business, but for legal or tax matters, it is best to consult an expert. A lawyer or accountant will be your best ally for binding tax and legal consultations.

Although we are here to support you, remember that we are not lawyers. For those more complex legal dilemmas, we will help you find a qualified professional.

The information provided may change, so we recommend that you do not consider it immutable.