EIN (Employer ID Number)

Your company's tax ID. Without this, you're nobody in the U.S.

2026 Edition

In today's ever-changing economic landscape, digital entrepreneurs and service professionals face constant challenges: from managing international operations and finding efficient tax structures to protecting their assets and ensuring the viability of their projects both long and short term. And this is where it's important to be realistic: with 90% of startups failing in %, the priority is to survive and consolidate from day one 💡.

Achieving sustainable growth and sound financial planning in a constantly evolving global context requires strategic vision and a real understanding of the options offered by the international market. Those who understand and apply these tools will have a decisive competitive advantage.

I'll quickly tell you the case of Carlos, web designer freelance.

Just a year ago, Carlos worked exclusively with clients in Spain and faced a business management challenge that consumed his time and energy.

Today, after forming a LLC in the USA Within a fully legal tax framework adapted to its activity, it has managed to better organize its business, expand its international presence, and manage its resources more efficiently, always complying with its tax obligations both in Spain and abroad.

*Each case is unique, and results may vary. The key lies in proper management and a strategic approach that ensures regulatory compliance and project sustainability.

That's why we created this The Ultimate Guide to LLCs in Spain: to help you structure and grow your business, optimize its management and lay the foundations for a solid financial future, always within a legal and secure fiscal framework.

Boost your Global Vision.

Anticipate challenges and build a solid business future with strategies adapted to a constantly evolving environment.

🕒 This guide is not for reading in a hurry..

It will take you between 1 and 2 hours to read it completely, but each block is designed so that you can read it separately and put it into practice instantly.

Move at your own pace and return to each section as needed.

[Last updated: August 9, 2025]

Let's start by clarifying that LLC means Limited Liability Company, either "Limited Liability Company" in Spanish. They are very popular and flexible legal business structures for many digital business either freelance professionals.

Why? Because they offer the best of both worlds: limited liability (of a corporation) and flexible management and taxation (similar to those of a self-employed person or partnership), but with fewer formalities. 🙌

In many cases, LLCs operate as “pass-through” entities or transparent. This means that the profits they generate at the end of the year are directly attributed to their owner and must be declared in their Income Tax or the personal tax that corresponds to your tax residence. They cannot accumulate indefinitely without paying taxes. Therefore, LLCs are designed to check in, spend and tax in an orderly manner. 💸

Another advantage is that LLCs don't require a board of directors or mandatory annual meetings, which greatly simplifies their management. This is especially attractive for small businesses or solopreneurs. 👍

The call “pass-through taxation” implies that the profits and losses of the LLC are carried forward to the personal tax return of the member(s), avoiding double taxation that does affect corporations. 🙌

Limited Liability Company

(Limited Liability Company) Only exists in the United States

The double taxation It occurs when a company pays taxes on its profits in the country where it is registered and, subsequently, its owners return to paying taxes in their country of tax residence for the profits. dividends they receive. This system can generate a high tax burden for many entrepreneurs. In certain circumstances, LLC can help avoid this problem, since, if they are taxed as “pass-through” entities, the profits are attributed directly to the owner and are taxed only once, on their personal tax return, always in accordance with the tax regulations of their country of residence.

Passthrough Entity

Profits flow to you automatically at the end of the tax year (The LLC will not “store” money)

A quick example:

Imagine that you LLC gets €50,000 net profit. Being an entity "pass-through", those €50,000 are added directly to your personal tax base in Spain. This means that you will have to declare the full amount on your Income Tax as foreign attributable income, applying the section that corresponds to you according to the current Treasury scale for that exercise.

Imagine that this year you LLC bill 60.000 € and has 15.000 € in deductible expenses. The result is €45,000 net profit that, being an entity pass-through, are directly attributed to you as the sole member.

This means that you must declare those 45.000 € in Spain, in your Income Tax, within the section "Income Attribution Regime«. The LLC, by itself, does not pay taxes in the US.; only submits its reporting obligations through the Form 5472 and a 1120 pro forma.

In practice, your LLC:

Checklist to comply without errors:

Keep all receipts for your deductible expenses.

Keep all receipts for your deductible expenses. Prepare and present the Form 5472 (informational) in the US along with the 1120 pro forma.

Prepare and present the Form 5472 (informational) in the US along with the 1120 pro forma. Declare your profits in the Spanish personal income tax (Model 100).

Declare your profits in the Spanish personal income tax (Model 100). Lean on a specialized manager to make sure everything is correct.

Lean on a specialized manager to make sure everything is correct.To calculate the Personal income tax to pay if you have an LLC, you must apply the brackets that correspond to your income level. Keep in mind that these brackets vary slightly depending on the Autonomous Community where you live, so it's always a good idea to check the regulations specific to your region. 📋

Let's see an example using the Personal Income Tax brackets for 2025 in Catalonia. Suppose that you LLC bill 50.000 € and you have 10.000 € in deductible expenses. That leaves a net profit of 40.000 €, on which you will have to pay tax. Next, we'll use the table with the applicable tax brackets to calculate the corresponding tax:

| Income bracket | State | Autonomous | Total | Fee Section | Accumulated |

|---|

No personal/family minimums or other reductions. It's all piecemeal.

Another example: of the total IRPF to be paid on 40.000 € general base (without minimums or reductions), applying the 2025 IRPF sections in Catalonia:

Total IRPF: 2.490,00 € + 1.261,68 € + 856,18 € + 3.602,10 € + 2.363,63 € = 10.573,59 €.

Average type: 10.573,59 € / 40.000 € = 26,4 %.

Applicable marginal rate: 33,8 %.

When a LLC has a sole proprietor and has not made an election to be taxed as a corporation, the IRS may classify it as a Disregarded Entity. This means that for U.S. federal tax purposes, the LLC is “ignored” and everything is attributed directly to its owner.

For a tax resident owner in Spain, this implies:

Common mistake: Think of “disregarded” as nonexistent. It may be fiscally invisible in the US, but legally, the LLC remains a legal entity with its own EIN and the ability to sign contracts, open accounts, hire staff in other countries, etc.

In practice, this classification gives you the best of both worlds: tax simplicity in the US if there is no business connection there, and a legal shield that protects your personal assets.

Main characteristics of a Disregarded Single-Member LLC:

No permanent establishment

No offices/properties or salaried workers in the name of the LLC in Spain

Limitations to take into account:

Despite its advantages, this structure has certain restrictions:

It does not allow partners or shareholders, limiting possible avenues for financing or growth.

You must comply with tax obligations in both the US and Spain, which can add some administrative complexity.

Therefore, before choosing a Disregarded Single-Member LLC, it is important to carefully evaluate whether this structure fits your business and personal goals.

Limited Liability

Protection of your personal assets

This type of limited liability means that the owner of the LLC and his personal assets They are protected from any financial or legal issues that may arise. The obligations fall on the company itself, since the LLC is a legal person, similar to a Limited Company (SL) in Spain.

In practice, the risk is limited to the company assets and does not extend to the personal assets of its owners. This contrasts with the self-employed, where the entrepreneur and business are legally the same, and personal assets can be affected by debts or obligations of the business.

⚠ Important: if the owner offers personal guarantees for an LLC loan, it could be personally responsible of that debt. 😮

As you can see, the limited liability It is one of the great advantages of the LLC, but it is not absoluteThere are circumstances in which you could lose the protection of your personal assets and be liable for damages from your own assets.

Therefore, it is essential to manage the LLC prudently and always comply with current regulations. Avoid any illegal, fraudulent, or negligent activity that could compromise your legal security and that of your assets.

One of the most widespread myths is to think that if at the end of the year you leave the LLC bank account at zero, you avoid paying taxes or raising suspicions. This is not the case. Taxation is not based on how much money is left on December 31, but on everything that has happened during the year: invoicing, expenses and how it is documented.

❌ Nothing could be further from the truth.

Both the Treasury and the IRS are analyzing the flow: income, expenses, transaction consistency, and traceability. If you artificially "empty" the account but can't justify where the money went, the problem won't be the balance... but the lack of supporting documentation.

What you should do to be safe:

💡 Having a balance in your LLC account is not a problem If you can justify each transaction. The real risk arises when there are transactions without supporting documentation or invoices that don't match the declared activity.

bnet profit = Yoincome – Gastos deductibles*

*Deductible expenses: “Any expense related to your economic activity”

The rule is simple: You can only deduct expenses that are directly related to the activity of your LLC.

)

)💡 AdviceIf you're unsure whether an expense is deductible, ask yourself, "Is this expense essential for the LLC to operate and generate income?" If the answer is no or ambiguous, it's best not to deduct it.

Why might it be worth leaving net profit at 0?

Imagine that your LLC has invoiced 30.000 $ in 2025. During that same year, you have had the following expenses:

Total expenses: 30.000 $

Net profit: 0 $

Result: You don't pay any income tax, since no taxable income has been generated. But be careful: you should keep invoices, receipts, and contracts in case the Treasury asks you to justify these expenses.

Therefore, you don't need to leave the account at zero: you need that everything that has happened to her is well justifiedIf the numbers add up and the documentation supports each transaction, the Treasury has no way in.

This is the most sophisticated and dangerous myth surrounding LLCs for tax residents in Spain. It's based on a very attractive theory that goes like this:

“If your LLC is a Foreign-Owned Disregarded Entity, U.S. law doesn't attribute profits to you; it only requires you to report transactions such as distributions. Since this attribution isn't enforced at source, you only pay tax in Spain on the money you actually withdraw from the company.”

It is the famous thesis of the “Well, technically…”. Its foundation is a literalist and technical interpretation of the rule, focusing on IRS forms rather than the substance of the matter.

The Reality: Clash with the Treasury Steamroller

Although the technical defense is intelligent, it clashes with the principle that the Tax Agency systematically applies: economic reality.

Inspector's conclusion: The profit is yours from the moment it is generated and, therefore, you must include it in your personal income tax through the Income Attribution Regime (RAR). For the Treasury, that your LLC is disregarded It is the ultimate proof of its total transparency, not a shield of opacity.

The Verdict: Operational Risk vs. Theoretical Reason

Is it a lie that “you only pay taxes on what you distribute”? Not quite. It is a high-risk bet with a defensible technical rationaleThe argument isn't about who's right in a theoretical debate, but about the operational risk you're willing to take in practice.

.

.

.

.For him 99% of entrepreneurs, the aggressive path is a battle that is not worth it due to its enormous cost in time, money and stress. Don't confuse a technical legal defense with a sound tax strategy.The sensible thing to do is to tax based on income attribution. Peace of mind is priceless.

If you are an entrepreneur in Spain (or live outside Europe) and you work in the digital world with clients spread all over the planet, there is a legal structure that can become your best ally: the LLC.

The LLC is a limited liability company created in the United States that allows you Optimize your management, pay less taxes legally, and protect your personal assets.All in a flexible format designed for global businesses like yours.

Now, not everyone is a good fit for an LLC. But if you fit any of these profiles, you're probably losing money and peace of mind by not having one:

Basically this

If this is your routine, the LLC is your best friend.

There are certain profiles of digital entrepreneurs that can make the most of a LLC in the USABut beware: It is not a universal solution and it is not always the best option for everyone.

Before taking the plunge, it's key to analyze your specific case: your business, the type of clients you have, where they're located, and what your medium- and long-term goals are. You should also be well-versed in your tax, legal and administrative obligations both in the United States and in Spain.

Therefore, my recommendation is clear: get advice before decidingWe can help you assess the advantages and disadvantages of your situation, and help you create and maintain your LLC in a way that is 100% legal, secure, and tailored to your business.

💡 A good structure can be the difference between a business that grows unchecked and one that drowns in unnecessary taxes and paperwork.

An LLC is not for everyone

If you are on this list... we are very sorry 🙁

Although LLCs offer a structure flexible and very attractive for the digital entrepreneur, its real convenience depends on both the nature of your activity as of you tax residenceTo operate with complete legal certainty, it's key to understand which business models are truly compatible with an LLC under the legal framework of the U.S. and your country of residence.

In the case of Spain and the United States, Only certain types of activities take full advantage of this vehicle's potential.The golden rule is twofold: avoid generating permanent establishment in Spain and not fall into the category of ETBUS (Engaged in Trade or Business in the US) on US territory.

Search for your activity to find out if you can operate without a Permanent Establishment in Spain.

| Activity | Verdict | Quick Analysis |

|---|

If you find yourself in any of these cases, an LLC on its own It is not the definitive solutionHowever, you can opt for combined strategies:

This way, you separate risks, optimize taxation, and comply with regulations in both countries.

The term ETBUS (ANDngaged in Trade or business in the ORnited Yestates) is the criteria the IRS uses to decide whether your activity is sufficiently connected to the U.S. that you have to pay federal taxes there. It doesn't just depend on where you are physically, but on whether your business has presence or means in US territory.

Even if your LLC is a disregarded entity (taxes in your name, not in the company's name), can be considered ETBUS if it meets certain criteria, which would generate federal tax obligations.

It is analyzed on a case-by-case basis, but the most common scenarios are:

Not typically applicable to 100 % digital structures without media in the US.

Not typically applicable to 100 % digital structures without media in the US. If you sell services from outside to clients in the US, there are nuances: it is not always “effectively connected”, but If the activity is regular, directed to the US and you have many clients there, the IRS could consider you an ETBUS.

If you sell services from outside to clients in the US, there are nuances: it is not always “effectively connected”, but If the activity is regular, directed to the US and you have many clients there, the IRS could consider you an ETBUS. With occasional sales or small revenue in the US, it's unlikely you'll be classified as an ETBUS; if you're planning to scale up there, consult with a tax professional first.

With occasional sales or small revenue in the US, it's unlikely you'll be classified as an ETBUS; if you're planning to scale up there, consult with a tax professional first.

Engaged in Trade or Business in the US

Note: ETBUS isn't the only criterion that can affect your US taxation. Factors such as the type of entity, the tax treaty between your country and the US, and applicable deductions or credits also count. Before taking the plunge, speak with a tax advisor familiar with the US market.

Create an LLC (Limited Liability Company) can be a good option for entrepreneurs and digital companies looking to optimize their structure for global expansion and efficiency. Below, we explore the key reasons to consider this legal form:

To simplify the declaration and payment of all the collected VAT, the one-stop shop system is used (Non-Union OSS).

The Criterion of Reality: If you live in Spain and your income depends on your direct work (typing, designing, consulting), the Administration considers that the activity is "personal and direct".

The Paradox of Transparency: Since an LLC is a tax-transparent entity (the profit goes to your personal income tax), it's inconsistent to claim to Social Security that the company is an opaque entity independent of you. If you're transparent in receiving payment, it's presumed that you're the one performing the work.

The Real Risk: It's not just about the Tax Office proving that the LLC is a front; it's about Social Security applying the rule of "Effective Control"If you have the company's 100% form and you have no employees, the legal presumption is that you are the worker, which requires registration in the RETA (Special Regime for Self-Employed Workers).

In any case, it is your responsibility to inform yourself and declare your income and pay the corresponding taxes in your country of residence. LLCs are based on common law and may have tax and legal implications that vary by jurisdiction. Before forming an LLC, be fully informed about all the implications and consult with a qualified international tax expert.

To find out if you are obligated to pay the fee, we need to analyze the nature of your activitynot the shape of your company. Here's the roadmap:

Updated reference guide (2025) on the mandatory registration in RETA for LLC partners residing in Spain.

| Type of Activity | Partner's Role (You) | Risk Level | Technical and Operational Analysis |

|---|---|---|---|

| Professional Services Marketing, Consulting, Programming, Copywriting |

Direct Executor. Billing depends on your hours. |

MANDATORY REGISTRATION |

"Highly Personal" Criterion: If you regularly invoice high amounts (>SMI), the Tax Office assumes you work from Spain.

Opinion: Here, RETA and the Tax Office are mandatory to avoid tax fraud through simulation. |

| Micro-Activity Side-Project, Beta Testing, Residual Income |

Bootstrapper (< SMI). Low or no LLC billing. Profit ~0. |

NOT MANDATORY** |

Jurisprudence Shield: Without income above the minimum wage, there is no "regularity" for RETA.

Strategy: Without registration in the Tax Registry to avoid admitting "Permanent Establishment". It is declared in the annual Personal Income Tax return under the Income Attribution Regime (RAR). |

| Business Activity Amazon FBA, Dropshipping, Automated SaaS |

Manager / Admin. The system generates the sale. |

NOT MANDATORY* |

Criterion "Entity Activity": The LLC conducts the business.

*Condition: Remote management. No physical office or employees in Spain to "materialize" the company here. |

| Agency with Structure You subcontract the technical execution |

Commercial Director. You get clients, others execute. |

GRAY ZONE |

Depersonalization: If third parties execute, the personal link is broken.

Risk: That your "management" role be considered a highly personal activity. |

| Holding Company Stocks, Crypto, Real Estate |

Investor. Mere possession of goods. |

EXEMPT | Mere Possession: Managing one's own private assets never requires registration in RETA. |

| International Transition Imminent departure (< 60 days) |

Settlement. Residual pre-transfer activity. |

DEFENSIBLE | Lack of Habituality: By breaking tax residency soon, you attack the time requirement. |

This table has a strategic character. (**) The "No Census" strategy for micro-activities aims to avoid the presumption of Permanent Establishment, based on the fact that the activity is carried out by the foreign entity. It requires meticulously declaring income in the Personal Income Tax Return (RAR).

We arrived at the black beast to operate in Europe with an LLC: the VATWith 27 countries, each with their own rules, this can feel like a real bureaucratic labyrinth.

The goal of this section is to give you a clear and straightforward map.

Before we dive into the comparison table, it is crucial that you know a "shortcut" that can change the rules of the game: the

Merchant of Record (MoR).

Imagine that instead of your LLC selling directly to the end customer, you sell to a intelligent intermediary (as Hotmart, Paddle either Lemon Squeezy), and it is this intermediary who becomes the legal seller.

In practice, this means that The whole "brown" VAT issue becomes your problem, not yours. With a MoR, the platform takes care of everything:

Calculate and charge the correct VAT depending on the country of each buyer.

Calculate and charge the correct VAT depending on the country of each buyer. Submit tax returns and pay VAT to the 27 EU tax authorities.

Submit tax returns and pay VAT to the 27 EU tax authorities. He transfers the net money to you, discounting its commission (normally a 5-10%).

He transfers the net money to you, discounting its commission (normally a 5-10%).This solution is perfect for those who sell B2C digital products in Europe and wants maximum simplicity.

In the following table, you'll see this turnkey strategy versus direct management head-to-head, so you can choose the path that best suits your business.

Strategic guide with official references (2025)

| Product / Service | Customer | VAT situation | Complexity |

|---|---|---|---|

| 🏢 Business Sales (EU) Any digital service or license. | 🏢 B2B | ✅ VAT FREE Apply Reverse ChargeYou must validate the VAT Number. |

BAJA (Check VIES)

|

| 🧑💻 One-on-one Personal Service Consulting, Design, Live Coaching. | 👤 B2C | ✅ NOT SUBJECT Location rule: Not subject to the law when supplied from outside the EU. See Explanatory Notes. |

LOW (Net invoice)

|

| 💿 Automated Digital Product Ebooks, Recorded Courses, SaaS. | 👤 B2C | ⚠️ INCLUDES VAT Taxes paid at destination. Registration required. One-Stop Shop (OSS) or use Stripe Tax. |

REGISTRATION (Quarterly Declaration)

|

| 🛒 Sale via "Reseller" (MoR) Hotmart, Lemon Squeezy, Paddle. | 👤 B2C | ✅ VAT MANAGED They act as the legal seller. You receive net royalties. |

LOW (Zero Bureaucracy)

|

| 🎤 Virtual / Hybrid Events Live streaming, online conferences. | 👤 B2C | 🚨 LAW CHANGE 2025 New Directive 2022/542They will be taxed at the consumer's location (they will include VAT), just like digital products. |

MEDIUM (Get ready now)

|

The exception is not in the format, but in the nature and fundamental value of service.

The key is whether you can make a strong case that what you are selling It is NOT a course with support, but a mentoring or personal consulting service which includes support material.

Think of two models:

Standard Hybrid Model (VAT included):

Standard Hybrid Model (VAT included): The Exception: Asynchronous Personalized Mentoring Service (arguable as NOT subject to European VAT)

The Exception: Asynchronous Personalized Mentoring Service (arguable as NOT subject to European VAT)

For this service to be considered “not subject to European VAT” Under the general rule, the following conditions must be met simultaneously:

This is not a strategy that works for all cases. If you want it to be defensible upon inspection, you must comply these three points to the letter:

❗ Final note:

If you regularly provide the service from Spain or any EU country, the tax authorities may consider that the place of provision is within the Community territory and, consequently, require VAT. The simple fact of invoicing from an LLC in the United States is not enough on its own: what really matters is who provides the service and from where.

Does the client pay me for a product that I could sell 1,000 times as is (a course, an ebook) or do they pay me for my time and my brain applied to your particular case?

💡 The first option carries VAT. The second No (considered a personalized professional service subject to the general rule of localization outside the EU).

A Anonymous LLC It is a company registered in states such as New Mexico, Delaware or Wyoming, where the owner's name does not appear in public records. This added privacy can be very useful in sectors such as cryptocurrencies, cybersecurity either trademark protection, where strategic anonymity is an added asset.

But beware: Registration anonymity does not exempt you from your tax obligations. As a resident of Spain. This is where many people get confused... 😬

Which YEAH makes anonymity:

Which NO makes anonymity (and here comes the important part):

❌ It does not eliminate your obligation to report LLC income. in personal income tax if you are a Spanish tax resident.

❌ It does not allow you to deduct personal expenses as if they were business (Mercadona, rentals, vacations… you know 😉).

❌ It does not protect you from the Treasury If you make unjustified transactions between the LLC account and your personal accounts in Spain.

So, is it good for anything?

Yeah, It serves to protect your privacy, not to hide income. A well-used anonymous LLC:

Of course, as long as correctly declare your income and comply with your tax obligations as a Spanish taxpayer.

Privacy is a tool for protection, not for hiding.

⚠ Although there is currently no requirement to report to FinCEN if you are a nonresident and your LLC doesn't have an ECI/ETBUS, laws change. Stay up to date to avoid surprises.

Anonymity can be a commercial shield, but it is not a tax shield. Complying with the Treasury is not optional, but how you structure your business is. The key is to optimize without crossing the line. 😊

⚠️ It is critical to understand the responsibilities of operating an LLC. Lack of awareness or failure to comply with regulations can lead to significant risks. Our goal is to help you understand why you should always act within the legal framework to prevent unnecessary consequences.

Key responsibilities to keep in mind:

- Tax compliance in both countries: US reports (e.g., 5472 + 1120 pro forma if applicable) and Spanish declaration (IRPF via RAR, where applicable).

- Real patrimonial separation: separate bank accounts, contracts in the name of the LLC and internal records organized.

- Documentary support: invoices, contracts, bank reconciliations and evidence that proves each transaction.

- Prevention of permanent establishment: Avoid offices, employees or dependent agents in Spain if your model does not include them.

- VAT/international sales: Check VAT/OSS rules in the EU or use a Merchant of Record when convenient.

💡 Conclusion: The LLC is a powerful tool if managed rigorously. With good planning and compliance, you will have protection, order and tranquillity.

⚠️ Most common mistakes and risks

✅ Keys to a smooth completion

💡 Remember: Meeting your tax obligations is not optional; it is the basis for maintaining your legal security and the sustainability of your global business.

Starting a business in the US is much more simple and digitized than in many other countries, where procedures are usually in-person and more complex. 🙌

So cheer up! These requirements are already included in our service. If you meet them, the process will be fast and 100% online:

USA It is a very destination attractive for entrepreneurs who want establish an LLC (Limited Liability Company).

The process is economical, fast and simple, and offers a series of both fiscal and operational benefits.

The LLC was born in the USA to provide a legal solution to the self-employed with moderate income.

Over time, it has evolved to become a popular choice even for companies that handle million dollar transactions.

In addition, it allows the non-resident foreigners can create and manage a business in the U.S. without having to travel to the country.

Important: The U.S. isn't the only option. Depending on your goals, other countries also offer opportunities for starting a business from abroad.

Important: The U.S. isn't the only option. Depending on your goals, other countries also offer opportunities for starting a business from abroad. Ireland:

Ireland: Corporate tax of the 12,5%, one of the lowest in the EU.

Corporate tax of the 12,5%, one of the lowest in the EU. Privileged access to the European market (500+ million consumers).

Privileged access to the European market (500+ million consumers). Dynamic economy with sectors such as technology, pharmaceuticals and finance.

Dynamic economy with sectors such as technology, pharmaceuticals and finance. Legal form: LTD (Limited Company), equivalent to the LLC, but requires at least one director resident in the EU.

Legal form: LTD (Limited Company), equivalent to the LLC, but requires at least one director resident in the EU. Estonia:

Estonia: The most digitalized country in the world, with 100% online administration.

The most digitalized country in the world, with 100% online administration. Possibility of obtaining the e-residency to create and manage your business from anywhere.

Possibility of obtaining the e-residency to create and manage your business from anywhere. Legal form: OÜ (Osaühing), equivalent to the LLC, with the tax advantage of deferring taxes until profits are distributed.

Legal form: OÜ (Osaühing), equivalent to the LLC, with the tax advantage of deferring taxes until profits are distributed.Other countries such as Singapore, Hong Kong and Cyprus also offer interesting alternatives.

Before deciding, compare the pros and cons and consult with an international tax expert to choose the best option for your business.

Have a company in the United States It involves complying with two tax authorities: 🇪🇸 Spain and 🇺🇸 USA.

Institute Revenue Service

There you only inform, information is power.

The IRS (Internal Revenue Service) It is the United States tax agency, and applies different rules to LLCs depending on their number of members and the tax option chosen.

Domestic LLC with two or more members:

Domestic LLC with two or more members: Members declare and pay taxes on their share of profits.

Members declare and pay taxes on their share of profits. You can choose to be treated as corporation, in which case the LLC pays taxes and then the members pay dividends.

You can choose to be treated as corporation, in which case the LLC pays taxes and then the members pay dividends. For this option the following is presented: Form 8832.

For this option the following is presented: Form 8832. Unipersonal LLC (Single Member Disregarded Entity):

Unipersonal LLC (Single Member Disregarded Entity): The owner declares and pays taxes as if he were self-employed, but in his country of tax residence.

The owner declares and pays taxes as if he were self-employed, but in his country of tax residence.

Important:

Important:Spain and the United States They have an agreement so that citizens and companies that generate income in both countries do not pay taxes twice for the same reason.

Imagine if you're from one country and earn money in another. This agreement means you may not have to pay taxes in the country where you earned that money.

If you're Spanish and earn money in the U.S., you may not have to share your profits with the U.S. government.

If you're Spanish and earn money in the U.S., you may not have to share your profits with the U.S. government. If you have already paid taxes in the US, you can deduct what you paid there is compared to what you have to pay in Spain for that same income.

If you have already paid taxes in the US, you can deduct what you paid there is compared to what you have to pay in Spain for that same income. Main benefit: Avoid paying taxes twice on the same income in two different countries.

Main benefit: Avoid paying taxes twice on the same income in two different countries.

If you want more details, you can consult the Double taxation agreement signed by Spain and the United States. (in force since 22 February 1990).

This agreement also includes other advantages, such as the elimination of double taxation on dividends, interest, and royalties, and the reduction of withholding taxes. Before doing business between Spain and the United States, be fully informed about the conditions and benefits. A tax advisor specializing in the US market can save you trouble and money.

Important: Complying with the rules of this agreement requires making correct declarations in both countries and keeping all documentation.

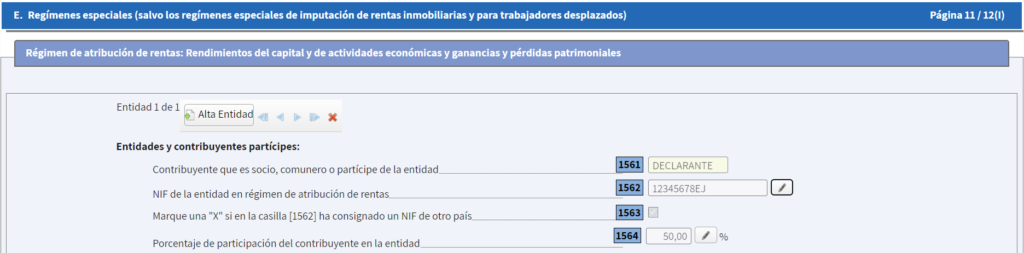

Important: Complying with the rules of this agreement requires making correct declarations in both countries and keeping all documentation.Entities in the income attribution regime (RAR) These are entities that do not pay taxes as an entity, but rather their income is distributed among their members, who declare it on their own tax returns.

Also applies to some foreign entities, such as American Single Member Disregarded LLCs, which operate in Spain and pay taxes in an equivalent manner. 🌐

📌 Query:

A Spanish tax resident is the sole owner (100%) of a American LLC "disregarded" (that is to say, fiscally transparent in the US), which offers online services and does not have EP in Spain.

Ask if you should report the profits of the LLC on the model 100 (IRPF), in the section E. Income attribution regime, although the model program only allows up to 99% to be included, and he has 100%.

✅ Administration Response:

📌 Query:

When are you going to declare these returns:

🛑 Result: If you enter 99%, the model will only declare 99% of the actual profit, and you will be leaving money untaxed (even if it is unintentional).

✅ The solution (accepted by the Treasury)

The Treasury has acknowledged in an official response that this limit of 99% is a technical error in the program, but that's it does not exempt you from declaring the 100% of the attributed income.

Therefore, the solution is:

💡 Adjust the total performance so that the 99% equals the actual 100%.

🧮 Practical formula

If the actual profit of your LLC is, for example, 100.000 €, you must:

The model will calculate:

99% of €101,010.10 = exactly €100,000 → ✅ Correct

🚫 What NOT to do

[Remember that you are responsible for ensuring that all the information you provide is accurate and truthful. This means that if there are any errors or inaccuracies in your statement, you will be solely responsible.

It is highly recommended that you consult with a tax manager or professional before submitting your return to the tax authorities. This is important to ensure that you are complying with all tax rules and regulations, and to avoid potential fines or penalties.]

Alternatively, if you do not want to do it yourself or your return is more complex because you have other income and special considerations, we strongly recommend using professional services such as TaxDown (plan FULL) to ensure that your tax return is handled correctly and efficiently.

Additionally, it is important that you have the following documents prepared or on hand in case they are later required by the Treasury:

Having these documents will facilitate the filing process and ensure that you are prepared for any requests for additional information from the tax authorities.

📩 Text to send to TaxDown:

Hello,

I have an LLC in the US as single-member disregarded entityI am a tax resident in Spain and I have already received confirmation from the DGT (General Directorate of Taxes) that I can apply the income attribution regime for personal income tax.

I want you to help me with my tax return, including what needs to be reflected from the LLC (income, expenses, etc.), as if it were my economic activity under direct estimation.

I need to know:

• What exact documentation or information do you need to include the LLC's data in your personal income tax return?

• How do I pass the data to you (PDF, Excel, Access, etc.)

Thanks in advance.

When operating your business internationally, it is essential to plan how to manage your social protection and you financial futureAn LLC gives you business flexibility, but that flexibility requires a personal strategy for your long-term well-being. 🌍

Key considerations for your financial future:

A LLC (Limited Liability Company) It is an entity governed by the legislation of the US state where it is created (Delaware, New Mexico, Wyoming, etc.).

This means that it is subject to US regulations, even if you operate 100 % online and live in Spain or Europe.

Now then, What makes the tax difference is not where the LLC was created, but how and from where it actually operates..

The concept of Permanent Establishment (PE) determine if the IRS can treat your LLC as a Spanish company for tax purposes (and therefore require VAT, IS, etc.).

According to the Article 5 of the OECD Model Convention and the Article 6 of the Non-Resident Tax Law, a foreign entity has a PE in Spain if:

This is true if:

Instead, the benefits are attributed to the owner, who pays personal income tax as a natural person under the Income Attribution Regime.

Then:

No Corporate Tax.

No obligation to apply VAT on behalf of the LLC.

Without the company being considered a tax resident in Spain.

And yes: this structure can offer greater operational efficiency and legal security if it is well set up and managed.

Did you know there are over 2 million LLCs registered in the U.S.? They're very popular among American entrepreneurs for their flexibility and protection.

Establishing an international presence with your LLC requires a good understanding of the implications of your tax residence and how each country's regulations affect your business structure. The tax treatment of your LLC and your income can vary greatly depending on your current and future country of residence.

But Each country has its own way of looking at an American LLC, and what in Spain is considered a transparent entity (pass-through), In others it may be irrelevant or even treated as an opaque entity subject to CFC rules..

🧠 The CFC Rules (Ccontrolled Foreign CCorporate Rules) are rules that some countries apply to prevent their residents from parking profits in foreign companies with lower taxes.

(Basically, they're trying to prevent you from setting up a company abroad just to defer or avoid taxes, when in reality you control it and it has no real structure.)

The choice of your tax residence directly impacts the management of your LLC and your tax obligations. Each country has its own regulatory and tax frameworks that you should evaluate based on your needs. personal and business goals and the fit with your international structure.

It is crucial to perform an individualized analysis to:

Classify your LLC in the new country (transparent, opaque, hybrid) and understand their effects.

Classify your LLC in the new country (transparent, opaque, hybrid) and understand their effects. Evaluate CFC standards and how could they impute you undistributed profits.

Evaluate CFC standards and how could they impute you undistributed profits. Determine taxation of the LLC's income (distributed or not) under local regulations.

Determine taxation of the LLC's income (distributed or not) under local regulations.What to look for in each country (quick checklist):

Treatment of CLL: Pass-through, company subject to IS, hybrid entity?

Treatment of CLL: Pass-through, company subject to IS, hybrid entity? Permanent establishment / significant presence: offices, employees, dependent agents, or effective management.

Permanent establishment / significant presence: offices, employees, dependent agents, or effective management. CFC Standards: participation/control thresholds, low taxation test, substance tests.

CFC Standards: participation/control thresholds, low taxation test, substance tests. CDI and withholdings: existence of a treaty, types of withholding tax (royalties, interest, services) and credit mechanism at destination.

CDI and withholdings: existence of a treaty, types of withholding tax (royalties, interest, services) and credit mechanism at destination. Personal tax residence: days of stay, center of vital interests, habitual residence, effects of a change of residence.

Personal tax residence: days of stay, center of vital interests, habitual residence, effects of a change of residence. Reporting and compliance: information templates, CRS/FATCA, banking requirements (KYC/AML) and supporting documentation.

Reporting and compliance: information templates, CRS/FATCA, banking requirements (KYC/AML) and supporting documentation. VAT: B2B/B2C rules, OSS (or MoR if applicable), and local sales links.

VAT: B2B/B2C rules, OSS (or MoR if applicable), and local sales links. Social security: mandatory contributions, bilateral agreements and coverage (health, pension).

Social security: mandatory contributions, bilateral agreements and coverage (health, pension). Effective taxation: marginal rates, exemptions/deductions, imputation of income and treatment of dividends/capital gains.

Effective taxation: marginal rates, exemptions/deductions, imputation of income and treatment of dividends/capital gains.

For one strategic and legally compliant international tax planning, a detailed analysis of your personal and business situation in relation to the laws of your country of residence and the jurisdiction of your LLC is essential.

Even if your LLC is registered in

However, if your LLC is a disregarded entity and in Spain it is considered under the income attribution regime (RAR)It does not have its own tax personality and cannot be considered a tax resident in Spain.

In that case, the effective management has no legal effect on the entity, and taxation falls directly on the partner through the Personal Income Tax.

"An entity is considered to have tax residence in Spain when has its effective management headquarters in Spanish territory. It will be understood that there is an effective address when the address is located in Spain. direction and control of all its activities."

In practical terms, the effective direction This only has an impact if the entity is a separate taxpayer. That is, if your LLC:

It was not incorporated under Spanish law.

It was not incorporated under Spanish law. It has no registered office in Spain.

It has no registered office in Spain. But You manage everything from Spain. and also The LLC is taxed as a corporation (C-Corp), Tax authorities I might consider who has tax residence in Spain (art. 8.1.c LIS).

But You manage everything from Spain. and also The LLC is taxed as a corporation (C-Corp), Tax authorities I might consider who has tax residence in Spain (art. 8.1.c LIS).

Although it is not mandatory, delegate operational management in a professional manager In the United States, it provides evidence and substance. A manager is a U.S. entity or professional who:

Assumes the administrative management and legal compliance from the LLC from the USA

Assumes the administrative management and legal compliance from the LLC from the USA Performs operational tasks and processes the necessary documentation with the IRS, FinCEN, BEA, etc.

Performs operational tasks and processes the necessary documentation with the IRS, FinCEN, BEA, etc. Coordinates with the registered agent and maintains corporate records and reports.

Coordinates with the registered agent and maintains corporate records and reports. It provides documentary evidence that the management is effectively carried out from the U.S.

It provides documentary evidence that the management is effectively carried out from the U.S.

Having a professional manager does not change the tax treatment of an LLC disregarded, but if strengthens international coherence and demonstrates that the entity has a presence in its country of incorporation. Documentary evidence shows that management takes place outside of Spain, which helps to avoid misinterpretations or misrepresentations.

This approach adds a layer of legal security and fiscal consistency to your structure, although it is always advisable to adapt the strategy to current regulations.

As managers of your LLC, we assume the administrative and operational management of your company directly from the USA, guaranteeing its legal and tax compliance in that jurisdiction. Our goal is to offer you tranquillity and efficiency, so you can focus on what really matters: the strategic growth of your business 🚀.

📝 This entire relationship is formalized through a service provision contract between your LLC and our entity, a US person with operational headquarters in the USA This contract does not “transfer” the tax residence of the LLC —which in a disregarded entity It doesn't exist in Spain—, but It does document that executive management is carried out from the U.S.

This document is a Tangible proof of substance and international coherence that you can provide in case of inspection or requirement, supporting the correct operation of your structure.

🛠️ Creation and comprehensive maintenance of the LLC

We take care of setting up your LLC, processing your EIN, and ensuring it complies with all legal and corporate obligations required in the U.S.

📋 Operational Management and Compliance in the U.S.

We oversee the legal and tax status of the entity, maintaining up-to-date records and processing the necessary forms. We file annual returns with the IRS (Forms 5472 and 1120), FinCEN, and BEA (BE-13, if applicable), and manage the renewal of the registered agent, as well as any other federal or state requirements.

🤝 Support and Coordination

We offer ongoing support to resolve questions, coordinate procedures, and assist you with any requirements or processes that arise.

💬 Communication and ongoing support

We are available to answer questions, coordinate procedures, and assist you with inspections or official requests.

🎯 Commitment to Management and Compliance

We are committed to managing your LLC in a legal, efficient and transparent, acting on your behalf to ensure that your business operates with solidity and compliant with US regulations.

Important: This service is not a fiscal panacea, but it is an essential element for provide real substance to your LLC in the U.S. and Strengthen your documentary and legal defense in case of review by the Treasury or any other authority.

If you like ensure that effective management is exercised in the U.S. and strengthen the legal structure, the OA can formalize the delegation of management functions to a professional manager In U.S.A.

A well-structured OA with a manager should include:

Delegation of administrative and operational management: The manager is responsible for administrative, operational, and legal compliance functions in the U.S., ensuring that the LLC complies with its bylaws and local regulations.

Delegation of administrative and operational management: The manager is responsible for administrative, operational, and legal compliance functions in the U.S., ensuring that the LLC complies with its bylaws and local regulations. Clarity in roles: The OA defines the manager's responsibility for day-to-day management and compliance, while the owner maintains a strategic oversight role.

Clarity in roles: The OA defines the manager's responsibility for day-to-day management and compliance, while the owner maintains a strategic oversight role. Tax compliance: The manager handles tax and regulatory obligations to the IRS and other entities, including filing official forms.

Tax compliance: The manager handles tax and regulatory obligations to the IRS and other entities, including filing official forms.

A well-drafted OA and a professional US manager are key evidence that your LLC has substance and effective direction in your jurisdiction of incorporation. This strengthens the legal security of your structure and demonstrates compliance with international regulations.

In short, the OA is the legal backbone of your LLC. Well-designed, it allows you to operate with transparency, consistency, and efficiency, ready to respond to any information request.

If one day you receive a notice from the IRS advising of an inspection or investigation into your LLC in the U.S., take a deep breath.

Did you know that the first LLC (Limited Liability Company) was created in Wyoming in 1977?

By the 1990s, nearly all states had adopted this legal form, which combined the best aspects of partnerships and corporations. Thus emerged a solid legal framework that allowed entrepreneurs to choose a flexible and protective business form.

Today, LLCs remain very popular, especially in digital commerce and global entrepreneurship. Their success is due to the fact that they offer a perfect balance between the protection of a corporation and the simplicity of a partnership. Their advantages include:

Efficient organizational structure

Efficient organizational structure Simplified regulatory requirements

Simplified regulatory requirements Elimination of double taxation typical of traditional corporations

Elimination of double taxation typical of traditional corporationsWith these characteristics, LLCs have become a preferred option for businesses seeking to expand internationally and for digital startups that value speed and reduced bureaucracy.

And which states are the most advantageous for creating them?

If you want to create a LLC (Limited Liability Company) in USAIt's crucial to choose the state where you register wisely. Not all offer the same conditions or benefits, and some stand out especially for their tax, legal, and administrative advantages.

Among the most favorable for LLCs, the following stand out: New Mexico, Wyoming and DelawareEach one has characteristics that can be very attractive to Spanish entrepreneurs, depending on their goals and needs.

When operating your LLC In the US, it is key to understand how the Sales Tax (sales tax) to digital services, as it depends on the state where it's registered. Regulations aren't the same across the country, and following the rules will prevent surprises.

If you are a tax resident in Spain and want to create a company in USA, one of the best options is LLC (Limited Liability Company). This legal form allows you to own a foreign company without legal or tax issues. 🇺🇸

One of the great advantages of LLCs is that they are companies passthrough: They do not pay taxes at the entity level, but their profits are passed on to the owners, who declare them on their personal taxes. Furthermore, if your LLC does not have permanent establishment in Spain, is not subject to the taxation or regulations of a Spanish company. 😎

This makes them an ideal option for businesses that operate globally, without the geographic limitations that plague other business structures. This way, you can diversify your customer base and take full advantage of the opportunities in the digital marketplace. 🌎

Another advantage is that an LLC can be anonymous, offering greater privacy and protection. However, this feature can raise suspicions with tax authorities if there's no legitimate reason to open it abroad. 😓

Therefore, it is key to maintain transparency and comply with all tax obligations in both Spain and the United States. you will avoid problems with the Treasury and you'll fully enjoy the benefits of having an LLC. 🙌

Remember: LLCs with at least one foreign-owned 25% must file Form 25% annually. 5472 before the IRS (Internal Revenue Service) to report transactions between the LLC and its foreign partners. Failure to comply can result in fines of up to 25,000 $. We handle your annual filing for you, so you don't have to worry.

Opting for an LLC in the US represents a strategic decision for entrepreneurs and digital companies seeking operational efficiency and a solid legal framework Globally. This structure offers a series of advantages that position it as a key option for the success and growth of your international business. Here are some of them:

A single-member disregarded entity (SME) LLC allows you complete control over business operations without partners or complex structures. You can adapt to the digital market quickly and with less bureaucracy.

Limited protection

Limited protection Privacy in the Public Registry

Privacy in the Public Registry Simplified accounting

Simplified accounting Efficient set-up and maintenance costs

Efficient set-up and maintenance costs Reduction of bureaucracy

Reduction of bureaucracy

Access to Stripe USA

Access to Stripe USA Access to the dollar

Access to the dollar Access to better banks

Access to better banks Access to investment and financing

Access to investment and financing

Favorable business environment

Favorable business environment Reputation and credibility

Reputation and credibility Internationalization of your business

Internationalization of your businessEstablishing an LLC in the United States for your digital business can provide you with numerous advantages, from better access to banking services and the stability of the dollar, to the ease of using Stripe USA and the ability to internationalize your business. You'll also enjoy limited liability protection, simplified management, and a suitable framework for the growth and success of your global business.

If you have decided to open a LLC (Limited Liability Company) in USAYou should know that there are several responsibilities and obligations to fulfill. It's not enough to simply create the company: you also have to keep it up to date with the legal and tax requirements of both countries.

Some of the responsibilities you should keep in mind include:

Public Address in the USA: You must have a public address in the U.S. to receive business correspondence. This can be your office address, your home address, or a virtual mail service.

Public Address in the USA: You must have a public address in the U.S. to receive business correspondence. This can be your office address, your home address, or a virtual mail service. Registered Agent in the U.S.: The person or company that receives official notifications and certified mail on behalf of the LLC. Must have a physical address in the state where you registered the LLC and be available during business hours.

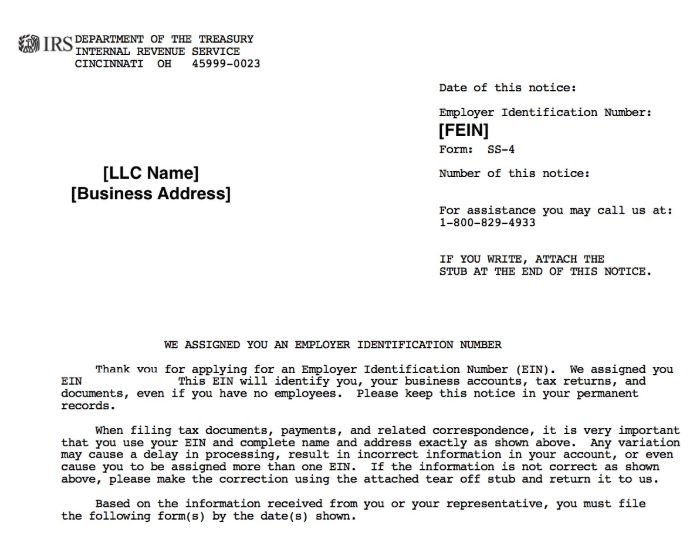

Registered Agent in the U.S.: The person or company that receives official notifications and certified mail on behalf of the LLC. Must have a physical address in the state where you registered the LLC and be available during business hours. LLC Documentation: Include the Certificate of Formation, the Operating Agreement, the EIN (Employer Identification Number), and, if your business requires it, the ITIN (Individual Taxpayer Identification Number). They must be complete and up-to-date.

LLC Documentation: Include the Certificate of Formation, the Operating Agreement, the EIN (Employer Identification Number), and, if your business requires it, the ITIN (Individual Taxpayer Identification Number). They must be complete and up-to-date.Regarding tax obligations, consider the following:

US Tax Return: The LLC must file an annual tax return with the IRS (Internal Revenue Service).

US Tax Return: The LLC must file an annual tax return with the IRS (Internal Revenue Service). Paying Taxes in Spain: As the owner of an LLC in the US, you must pay personal income tax in Spain on the profits you earn, declaring that income as income from economic activities.

Paying Taxes in Spain: As the owner of an LLC in the US, you must pay personal income tax in Spain on the profits you earn, declaring that income as income from economic activities.In addition, there are specific reporting obligations:

Form 1120 + 5472: Annual IRS return, including Form 5472 if you have at least one foreign-owned LLC. This is used to report transactions between the LLC and its foreign owners or partners.

Form 1120 + 5472: Annual IRS return, including Form 5472 if you have at least one foreign-owned LLC. This is used to report transactions between the LLC and its foreign owners or partners. BE-13: Federal Economic Survey for investments over $3 million in a U.S. LLC or investments received from abroad. Filed with the Bureau of Economic Analysis (BEA).

BE-13: Federal Economic Survey for investments over $3 million in a U.S. LLC or investments received from abroad. Filed with the Bureau of Economic Analysis (BEA).In Spain, you must also comply with reporting obligations:

Form 720: Mandatory if you have assets abroad valued at more than €50,000. This includes bank accounts, securities, stocks, insurance, income, or real estate. This must be submitted once, unless there are significant changes.

Form 720: Mandatory if you have assets abroad valued at more than €50,000. This includes bank accounts, securities, stocks, insurance, income, or real estate. This must be submitted once, unless there are significant changes.

You are not going to pay anything there

(Inform only)

If you have one LLC (Limitated Lreliability CIf you're an LLC (company) in the United States, it's important to understand its tax framework and how you can optimize your business's tax burden. The tax treatment of LLCs varies depending on several factors.

Among the conditions that you must meet are the following:

Compliance with these conditions may influence the tax efficiency of your LLC in the USIt's important to remember that even if your LLC is a "pass-through" entity (where profits are attributed to its owners for personal tax purposes), you are required to file an annual information return with the IRS (Internal Revenue Service).

When choosing your state of registration, it's important to consider the state's tax framework. Some states, such as Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, do not impose state corporate or personal income taxes. This feature can contribute to the overall efficiency of your structure, provided you comply with federal and state regulations. Therefore, we recommend analyzing the advantages of each state before choosing where to register your LLC.

Comparison of maintenance costs and privacy (2025)

| State | Annual Cost (Maintenance) | Privacy | Bureaucracy | Ideal For... |

|---|---|---|---|---|

| 🌵 new Mexico | $0 / year No annual report | HIGH | NULL | The King of Savings. Perfect for beginners, digital services and maximum privacy at zero cost. |

| 🤠 Wyoming | $60 / year Mandatory Report | HIGH | AVERAGE | The Classic. Excellent for Ecommerce, asset holding and wealth protection. |

| 🏢 Delaware | $300 / year Franchise Tax | AVERAGE | HIGH | Startups & Investment. Only if you're looking to raise capital. Expensive and complex for a freelancer. |

| 🌴 Florida | ~$138 / year Annual Report | NULL | AVERAGE | Vanity / Physical appearance. Your name and address are public on Sunbiz. Only if you live there or want to "show off". |

If you want to open a commercial bank account for your business, the first thing you should do is form a LLC (Limited Liability Company) in USA. Banks will ask you for a series of documents that you can only obtain when creating the LLC.

Among the documents you will need are the following:

Articles of Organization: Document certifying the creation of the LLC and containing basic company information, such as name, address, purpose, and members.

Articles of Organization: Document certifying the creation of the LLC and containing basic company information, such as name, address, purpose, and members. Tax Identification Number (EIN): Number that identifies the LLC before the IRS (Internal Revenue Service), equivalent to the NIF/CIF in Spain.

Tax Identification Number (EIN): Number that identifies the LLC before the IRS (Internal Revenue Service), equivalent to the NIF/CIF in Spain. Form SS-4: Form you must submit to the IRS to apply for an EIN. It can be submitted by mail, fax, or online.

Form SS-4: Form you must submit to the IRS to apply for an EIN. It can be submitted by mail, fax, or online.These documents prove the legal existence of your business and are essential for meeting banking requirements. Without them, you won't be able to open a business bank account for your LLC at a neobank.

CP 575, the long-awaited letter with your EIN number

The chart shows the average wait time (in weeks) to obtain an EIN depending on the month in which it is applied for.

🔴 In January and December The wait can last until 10 weeks.

🟡 From March to November, the time is more reasonable, between 4 and 6 weeks.

🟢 And the best time to request it is April to July, with only 3 weeks waiting.

👉 If you're thinking about setting up your LLC and need an EIN quickly, you already know which months to avoid 😉

Average delay in the allocation of the EIN for non-residents (via Fax/Mail) according to the month of application.

If you have one LLC (Limited Liability Company) in USA, you'll surely want to have a business bank account that offers you facilities and advantages for your business. But not all banks are the same, and some may put obstacles in your way or charge you exorbitant fees. Therefore, we recommend that you opt for the neobanks, digital banks that operate 100% online and offer you modern solutions tailored to your needs.

Among the most notable neobanks for LLCs, three stand out: Payoneer, mercury and wiseThese neobanks stand out for their compatibility with the cross-border and digital needs of LLCs.

Payoneer: American neobank operating in euros (€) and US dollars ($). It allows you to open a multi-currency account to send, receive, and convert money in more than 50 currencies with real exchange rates and no hidden fees. It includes a virtual and physical debit card for online payments anywhere in the world.

Payoneer: American neobank operating in euros (€) and US dollars ($). It allows you to open a multi-currency account to send, receive, and convert money in more than 50 currencies with real exchange rates and no hidden fees. It includes a virtual and physical debit card for online payments anywhere in the world. mercury: US dollar-denominated neobank ($) with an online business account, invoicing and accounting tools, integrations with Stripe and Shopify, and access to financing programs. It offers physical and virtual debit cards for online and in-store payments. this link you will have immediate access.

mercury: US dollar-denominated neobank ($) with an online business account, invoicing and accounting tools, integrations with Stripe and Shopify, and access to financing programs. It offers physical and virtual debit cards for online and in-store payments. this link you will have immediate access.

wise: Formerly TransferWise, it's a European neobank operating in over 50 currencies, including euros (€) and dollars ($). It facilitates international transfers with transparent fees, a real exchange rate, and low commissions.

wise: Formerly TransferWise, it's a European neobank operating in over 50 currencies, including euros (€) and dollars ($). It facilitates international transfers with transparent fees, a real exchange rate, and low commissions.Neobanks comply with the same regulations and guarantees as traditional banks. By operating online and without physical branches, they reduce costs and can offer you better terms and services. Therefore, trying out a neobank may be the step your LLC needs to simplify its financial management.

Did you know USA benefits from the LLCs (Limited Liability Company) that non-residents create? Although these entrepreneurs do not pay taxes on their businesses in the US, the country receives income in another way. 🇺🇸

Each year, LLCs must pay fees to the state where they are registered. These fees vary by state, but are usually around hundreds of dollars annually. If we add up the fees of all the LLCs in the US, the result is a substantial source of income for the country. 💵

But not only that, the US also benefits from the information it collects from LLCs. When creating an LLC, owners must provide key personal and financial information, such as the EIN (Employer Identification Number) and, in some cases, the ITIN (Individual Taxpayer Identification Number). This data allows the U.S. to monitor international financial activities and strengthen its market intelligence, giving it a competitive advantage in the global economy. 🚀

💡 There are more than 2 million LLCs LLCs are very popular among American and foreign entrepreneurs due to their flexibility and protection. Each state has its own rules and advantages, so choosing where to register wisely is key. For example, Delaware It stands out for its modern legislation, its court specializing in commercial matters, and its low taxes.Many entrepreneurs believe that LLCs (Limited Liability Company) in USA They don't need to keep formal accounts. But this is a myth which can cause problems. Although LLCs do not have to file full financial statements, they are required to report certain accounting information at the federal level.

The entities requesting this information are:

These agencies require key data such as: costs, income, expenses, profits, transactions, assets and liabilities. All of this is reported on specific forms such as the 1120, he 5472 and the BE-13.

Therefore, it is essential to carry a accurate and transparent accounting for your LLC. Avoid the mistake of incorrectly reporting or inappropriately deducting expenses. Accounting should reflect the financial reality of the company, as it is the basis for calculating personal income tax and any other taxes applicable in your country of residence. Proper accounting management is key to the legal security of your business.

To avoid mistakes, you should know which expenses are deductible and which are not:

If you have one LLC (Limited Liability Company) in USA, you should know that you have to include all the benefits of your business in the calculation of the Income Tax (Personal Income Tax) in Spain. This includes both amounts you withdraw and amounts you leave accumulated in the company. This way, you'll avoid problems with the Tax Agency and comply with your tax obligations.

The key is in maximize deductible expensesThese are expenses directly related to business activity and that are necessary and reasonable. When deducted:

You reduce the tax base (the amount on which taxes are calculated)

You reduce the tax base (the amount on which taxes are calculated) You pay less taxes

You pay less taxes You increase net profitability

You increase net profitability

If you're not clear about what you can and can't deduct, you could make serious accounting errors that could result in penalties. Therefore, it's essential to be familiar with the rules regarding deductible expenses, a topic we'll cover in detail in the next section.

If you have one LLC (Limited Liability Company) in USA, it is crucial to understand what expenses you can deduct from your businessOnly expenses that are directly deductible are linked to your business activity and necessary to generate income.

Principles of Deductibility:

Non-Deductible Expenses (common examples):

Spent Spent | USA (general criterion) | Spain (IRPF self-employed) |

|---|---|---|

| Business lunches | Deductible to 50% when it is ordinary and necessary | Deductible 10% (with limits and formal requirements) |

| Vehicles used for the activity | Deduction proportional to use accredited business | Deductible 30% if the affectation and requirements are proven |

| Fines and penalties |  Not deductible Not deductible |  Not deductible Not deductible |

Note: Percentages and criteria are subject to conditions and limitsAlways provide evidence (invoices, meeting agendas/justifications, usage sheets, etc.).

Risks of misuse:

Deductibility between jurisdictions: Rules may differ between the US and Spain. For your Income Tax As a Spanish resident, deductibility is governed by Spanish regulations, although In the US, certain concepts may be broader. Declare your LLC's profit in Spain according to Spanish personal income tax rules and document the adjustments.

Practical recommendation:

There are deductible expenses in the US that may not be in Spain (and vice versa). For prudence, guide your accounting with the Spanish personal income tax If you are a resident in Spain, always keep sufficient documentation for each deduction.

If you have one LLC (Limited Liability Company) in the U.S., you can deduct necessary business expenses… but be careful: if you are tax resident in Spain, the profits of your LLC are taxed in your Spanish personal income tax under the income allocation regime, and only You will be able to deduct the expenses recognized by Spanish law, although the IRS is more flexible.

Key idea: The profit you declare in Spain No is the net “IRS”, but the net after deducting only the expenses permitted by Spanish personal income tax law.

How does it affect you?

How to do it right?

Document absolutely everything: invoices made out to the LLC, contracts, payment receipts, emails/work orders.

Document absolutely everything: invoices made out to the LLC, contracts, payment receipts, emails/work orders. Only justified, routine and directly linked expenses to the activity (economic coherence).

Only justified, routine and directly linked expenses to the activity (economic coherence). If you doubt Regarding deductibility in Spain, consult a specialized tax advisor before including the expense.

If you doubt Regarding deductibility in Spain, consult a specialized tax advisor before including the expense.What does it mean in practice?

Inconvenient reality

Extra good practices

A visual guide to understanding what you can include in an LLC according to Spanish IRPF criteria.

No, and be careful with this myth that is circulating out there.

Some “LLC sellers” They assure that you can deduct up to 1,500 $ per month for working from home. The basis for this error often comes from a deduction that exists in the US called home office deduction, but it doesn't apply as you think, nor does it work in your context.

Let's go step by step

If you use an LLC disregarded and you pay taxes in Spain, this deduction No applies to your personal income tax. This only applies to those who file direct tax returns in the US.

If you use an LLC disregarded and you pay taxes in Spain, this deduction No applies to your personal income tax. This only applies to those who file direct tax returns in the US.

And most importantly, if you recognize part of your home as the LLC office, you may be generating Permanent Establishment (PE)…and that’s where things get complicated.

And most importantly, if you recognize part of your home as the LLC office, you may be generating Permanent Establishment (PE)…and that’s where things get complicated.💡 Conclusion: Neither 1,500 $/month in the US, nor 18,000 $/year in SpainIf you work from home, you can deduct what's reasonable and justified. Period. Don't confuse real deductions with tax marketing. Optimizing isn't inventing.

It is essential to carry one legal and transparent accounting for your LLC. Avoid the mistake of including illegitimate expenses, as this can lead to serious problems with the IRS in the US and the Spanish Tax Agency.

🚫 Risks of including illegitimate expenses:

📌 Principles of correct deductibility:

💡 Recommendation:

When two related companies (for example, with the same owner) carry out transactions with each other, these are considered related-party transactionsIt is essential that these operations be carried out under criteria of complete transparency and legality to ensure regulatory compliance.

Digital assets like NFTs (Non-Fungible Tokens) are a new innovation in the financial landscape. Understanding how transactions involving NFTs are handled in the context of your LLC is critical to ensuring proper tax compliance and avoiding risks.

If you want to create a LLC (Limited Liability Company) in USAWe make it easy for you. We take care of everything so you can have your business up and running in no time, without paperwork or complications. We work with New Mexico, one of the most advantageous states for LLCs.

Roadmap from registration to your first invoice.

Official registration in New Mexico/Wyoming. Assignment of Registered Agent and business address.

We prepare Form SS-4 and submit it via fax to the IRS to obtain your Tax ID.

With your EIN in hand, we'll open your account at Mercury, Wise Business or Relay Financial.

Payment gateway (Stripe) setup and invoicing. Your company is already legally established.

Why New Mexico: It's one of the most popular states for LLCs thanks to its simple formation, low costs, and efficient administrative framework, making it easier to maintain your company and allowing you to focus on growing your business.

If you want to create a LLC (Limited Liability Company) in USA, we offer you a comprehensive and affordable service to get your business up and running in no time. Our package costs $1,750 per year and will maintain this price until December 31, 2024 for existing customers.

Includes everything you need:

This plan simplifies administration and ensures that your LLC properly complies with all of its tax and legal obligations in the United States. You'll enjoy benefits such as limited liability protection, operational efficiency and ease of management for your global business.

We don't just give you "papers." We give you the master keys to operate, open bank accounts, and comply with the law.

Your company's tax ID. Without this, you're nobody in the U.S.

The original application sent to the IRS with your registration information.

Your LLC's official birth certificate, sealed by the State.

The internal instruction manual. It defines who the owner is (You).

The bridging document. We (the organizer) are passing the control to you.

Formalize your role as manager (if applicable). Separate ownership from management.

Mandatory declaration of foreign investment when creating the company.

Simple template to record income and expenses without complicating things.

Shortcuts and tips for opening Mercury, Wise, and Relay.

Setting up an LLC in the US on your own can seem like an epic adventure. But if you do it without a map or compass—without knowing exactly where you're sailing—you can easily end up running aground in murky tax waters.

Without experience, you're flying blind. And that, in international taxation, isn't romanticism... it's real risk.

For example:

Fines for not correctly filing Form 5472 (yes, the one that almost no one mentions) or the BE-13C can exceed 25.000 $It's like hitting an invisible iceberg: you don't see it coming... until it's too late.

Fines for not correctly filing Form 5472 (yes, the one that almost no one mentions) or the BE-13C can exceed 25.000 $It's like hitting an invisible iceberg: you don't see it coming... until it's too late.

Many people jump into creating an LLC thinking it's a simple "click, click, and done." But without prior training, it will take you weeks (or months) to understand:

And there's more:

Being able to sleep well at night… is priceless.

Even if you set up your LLC properly, that's just the beginning. After that, you need to maintain it:

Are you building a spontaneous venture or a solid foundation for financial freedom?

With our service, you not only get help creating your LLC:

Your LLC, well done, it's your ship.

Us, your on-board team.

AND USA, the ocean where you can play with advantage.